With the development of the semiconductor industry, driven by downstream demand such as mobile phones, communications, and consumer electronics, the application of power management chips has gradually increased. Relevant policies and talents are aligned with the market, the industrial environment is constantly improving, and the import substitution effect of power management chips has been significantly enhanced.

Market status

1. Market size

In recent years, the scale of China's power management chip market has maintained a growth trend. In 2021, the market size was about 76.3 billion yuan, a year-on-year increase of 2.69%. The market size in 2022 is about 81.065 billion yuan. With the growth of demand for power management chips in the downstream electronic equipment industry, the market size will continue to grow in the future, and it is expected that the market size will reach 85.138 billion yuan in 2023.

2. Downstream application

Currently, the downstream of power management chips is mainly used in three major fields: data processing, industrial medical care, and consumer electronics, accounting for 25%, 24%, and 23% respectively; consumer electronics accounts for 18%; automotive electronics and military aviation are both less than 10%, accounting for 9% and 1% respectively.

Power management chips are circuits that manage batteries and electrical energy. They are responsible for the conversion, distribution, detection and other electrical energy management of electrical energy in electronic equipment systems. According to their functions, they can be divided into application areas such as AC-DC, DC-DC, driver IC, linear regulator, multi-function PMIC, protection chip, battery management and wireless charging chip. According to the packaging form of the product, they can be divided into multi-channel integrated power management chips and single-channel power management chips.

Different devices have different functional requirements for power supplies, and different modules of the same device also need to be equipped with different voltages and current intensities. Therefore, power management chips are widely used in various electronic products and equipment, and are the largest subdivision in the analog circuit industry.

With the implementation of smart lighting, fast charging, and Internet of Things related technologies in the fields of LED lighting, general power supplies, and smart home related equipment power supplies, as well as the increase in people's demand for smart lighting, electronic products and smart homes, power management chips are facing new opportunities and challenges. On the one hand, this requires related products to be able to iterate quickly, and power management chips need to meet the needs of more efficient and precise circuit control. On the other hand, it also promotes the rapid expansion of the market size of the power management chip market.

With the development of 5G technology and the continuous improvement of mobile phone performance, mobile phones have put forward higher requirements for power management chips. On the one hand, the increase in mobile phone functional modules also requires the increase of power management modules accordingly. For example, the increase in mobile phone cameras means that more power management chips are needed. On the other hand, factors including fast charging, wireless charging and battery safety have put forward higher requirements for the quality of power management chips, which require the power management chips to be improved in quantity and performance.

Since 2016, the global power management chip market has continued to grow. In 2020, the market size reached US$32.88 billion, with an annual compound growth rate of 13.52%, and is expected to reach US$52.56 billion in 2025.

As the manufacturing centers of terminal consumer products gather in Asia Pacific and China, the entire power management chip design industry also shows a trend of shifting to China, which has brought greater development space and opportunities to domestic integrated circuit design companies. In the process of industrial transfer, large European and American integrated circuit design companies have shifted to markets with higher gross margins such as automotive and industrial grades, making it easier for domestic companies to enter the civilian consumer market; on the other hand, due to the Sino-US trade friction, the integrated circuit industry, as a strategic industry related to national security, has received strong support from the state, and the importance of independent substitution of domestic integrated circuits has been highlighted. Relevant policies and talents are in line with the market, and the industrial environment has been continuously improved. As domestic power management chip design companies continue to improve in fierce competition, the import substitution effect has been significantly enhanced.

At the same time, domestic demand will also be a huge driving force for the development of power management chips in the future. As the power supply center of electronic products and equipment, power management chips are irreplaceable key components in electronic products, and the market space is broad.

The scale of my country's power management chip market has increased from US$9.24 billion in 2017 to US$13.19 billion in 2021, with an average annual compound growth rate of 9.31%. With the expansion of the application of domestic power management chips in new fields and import substitution, the scale of the domestic power management chip market is expected to grow at a relatively fast rate.

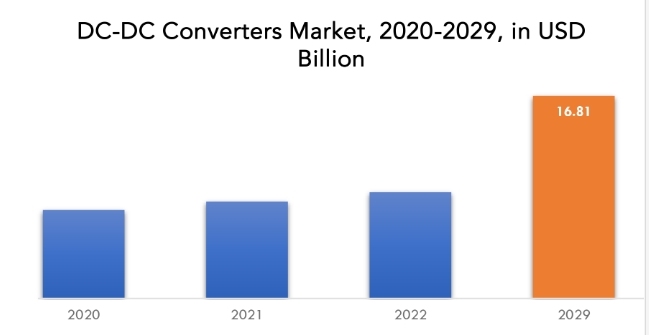

A DC-DC converter is a voltage converter that effectively outputs a fixed voltage after converting the input voltage.

DC-DC converters are divided into three categories: converters and buck-boost DC/DC converters. Various control methods can be used as needed. The PWM control type has high efficiency and good output voltage ripple and noise. Even if the PFM control type is used for a long time, especially when the load is small, it has the advantage of low power consumption. The PWM/PFM conversion type implements PFM control when the load is small, and automatically switches to PWM control when the load is heavy. At present, DC-DC converters are widely used in products such as mobile phones, MP3s, digital cameras, and portable media players. It belongs to the chopper circuit in the circuit type classification.

DC-DC converters are generally composed of control chips, inductors, diodes, transistors, capacitors, etc. When discussing the performance of DC-DC converters, if you only focus on the control chip, you cannot judge its quality. The component characteristics of the peripheral circuit and the wiring method of the substrate can change the performance of the power supply circuit. Therefore, a comprehensive judgment should be made.